State of Crypto Consumer Apps Report 2024

The future of consumer crypto apps is bright. With robust infrastructure in place, it's time to focus on creating experiences that bring the benefits of blockchain to millions of mainstream users.

Consumer Crypto App Report 2024 - August 2024

By Francisco Cordoba Otalora

1. Introduction

1.1 Overview of Consumer Crypto

Imagine a world where your morning coffee purchase, your afternoon ride-share, and your evening movie streaming all tap into the power of cryptocurrency without you even realizing it. That's the promise of Consumer Crypto - a realm where everyday folks interact with crypto-powered applications as naturally as they breathe.

Now, you might be thinking, "But Francisco, isn't crypto just for tech wizards and digital gold bugs?" Not anymore, my friends. Consumer Crypto is all about bringing the benefits of blockchain technology to the masses, seamlessly integrating it into the apps and services we use daily or weekly.

The potential here is enormous. We're talking about the possibility of reaching a billion users - that's more people than the entire population of Europe! But here's the kicker: we're not there yet. There's a gap between this potential and our current adoption rates that's wider than the Grand Canyon.

Why does this gap exist? Well, it's like trying to teach quantum mechanics to someone who's never heard of an atom. We've built amazing tools, but we haven't quite figured out how to make them accessible to everyone. That's the challenge - and the opportunity - that Consumer Crypto presents.

1.2 The Current Phase of Consumer Crypto (2024)

So, where are we now? If Consumer Crypto were a space mission, we'd be in the "orbiting the Earth" phase. We haven't landed on the moon yet, but we're definitely off the ground.

I like to call our current stage "Consumer Crypto for Crypto Users." It's a bit like preaching to the choir, but it's an important step. Most of the applications we're seeing are tailored for folks who already know their way around a crypto wallet and can tell their blockchains from their block heights.

These early adopters are crucial. They're like the first people who used email - they're figuring out the kinks, spreading the word, and paving the way for wider adoption. But they're also a niche group. They're comfortable with concepts like private keys, gas fees, and decentralized networks.

The challenge now is to bridge the gap between these crypto-savvy users and the average Joe or Jane. It's like we've built a fantastic quantum computer, but we're still figuring out how to give it a user-friendly interface.

This phase is exciting because it's laying the groundwork for what's to come. We're seeing innovative apps and use cases emerge, but they're still primarily serving those who are already in the crypto ecosystem. The next big leap will be adapting these technologies and interfaces to serve a broader audience - to create Consumer Crypto for everyone.

As we move through 2024, we're at a crucial juncture. The foundations are laid, the early adopters are on board, and now it's time to start building the bridges that will bring crypto into the mainstream consumer world. It's a tall order, but then again, so was splitting the atom - and we managed that just fine.

2. Phases of Consumer Crypto Evolution

2.1 Phase One: Consumer Crypto for Crypto Users

Description: Detailed analysis of the first phase, targeting crypto enthusiasts and early adopters who are willing to navigate the complexities of blockchain technology.

Farcaster: The Twitter/X of Crypto Consumer Social Apps

Overview

Farcaster has rapidly positioned itself as a leading social platform in the crypto ecosystem, often likened to the "Twitter/X of crypto." It allows users to post, interact, and engage with various forms of content, making it a central hub for the crypto community's social interactions.

Farcaster operates on the Optimism blockchain, a Layer 2 (L2) solution for Ethereum, enhancing scalability and transaction efficiency

User Growth and Adoption

As of 2024, Farcaster has seen substantial growth in its user base and activity metrics:

- Total Registered Users: 659,551

- Monthly Active Users (MAU): MAUs have seen a dramatic increase, growing 10X from January 2024, where the platform had 27,088 active users, to 277,070 in July 2024. This surge reflects a significant adoption curve, driven by several key developments and incentives.

Source: Dune Analytics

Engagement Concerns

While Farcaster has succeeded in expanding its user base, engagement metrics reveal a concerning trend:

- Engagement Decline: The engagement on the platform, particularly in the largest channels, has decreased since its peak in May 2024. A key indicator of this decline is the drop in user interactions. In February 2024, posts receiving 1-5 reactions represented 44.6% of total interactions, but by August 2024, this number had fallen to 20.8%.

- DAU and MAU Growth vs. Engagement: Despite the increase in Daily Active Users (DAU) and Monthly Active Users (MAU), the quality and frequency of interactions have declined, raising questions about the platform's long-term user engagement strategy.

Source: Dune Analytics

Blockchain Consolidation

Farcaster's integration with the Base blockchain has strengthened over the year:

- User Transactions on Base Blockchain: The proportion of Farcaster transactions on the Base blockchain, a Layer 2 (L2) Ethereum solution, grew from 54% in February 2024 to 89% in July 2024. This shift consolidates Base as the dominant ETH chain for Farcaster transactions, reflecting the platform's deeper alignment with this blockchain infrastructure.

Waves of New Users in 2024

The influx of new users to Farcaster in 2024 can be attributed to three significant events:

1. Launch of Frames (January 2024): Farcaster introduced Frames, interactive apps that users could run within the Farcaster social feed. These apps, which include games, polls, and other interactive experiences, broadened the platform's appeal and engagement potential.

2. Degen Token Peak (April 2024): The launch of the Degen token in April, designed to incentivize platform usage, led to a spike in user activity. The token's peak in value further attracted users, particularly those interested in the financial incentives associated with platform engagement.

3. $150M Fundraising Announcement (June 2024): Farcaster secured $150 million in funding from prominent venture capital firms a16z and Haun in June 2024. This infusion of capital not only signaled confidence in Farcaster’s future but also brought in a new wave of users interested in the platform's potential.

Current Challenges: Engagement and Interaction

While Farcaster has proven its ability to attract and retain users, particularly power users who have earned the Warpcast power badge, the platform now faces a critical challenge: sustaining and enhancing user engagement. The drop in interactions, despite the growing user base, indicates that the platform needs to find new ways to keep its users actively engaged.

Future Catalysts

To address these engagement challenges and propel the platform forward, Farcaster may need to consider the following catalysts:

- Enhanced Content and Interaction Features: Developing new features that encourage more meaningful and frequent interactions could reinvigorate user engagement.

- Gamification and Incentive Structures: Further refinement of the platform's gamification elements and incentive structures, perhaps building on the success of the Degen token, could help in retaining and re-engaging users.

- Strategic Partnerships and Integrations: Forming partnerships with other blockchain-based projects or integrating with popular crypto applications could expand Farcaster's utility and appeal, driving higher engagement.

- Community-driven Development: Empowering the Farcaster community to contribute to the platform's development could lead to innovative solutions and a stronger sense of ownership among users.

Lens: The Facebook/Meta of Crypto Consumer Social Apps

Lens positions itself as a pioneering social platform within the Web3 ecosystem, where users truly own their content. Unlike traditional platforms like Meta, Google, or X, where all content is subject to platform-specific terms and conditions, Lens empowers users to mint their posts—whether text, images, or videos—into unique digital assets that can be acquired or traded by others. This approach embodies the pure Web3 narrative of owning the internet and positions Lens as a hub for the crypto-native community.

Lens operates on the Polygon blockchain, a Layer 2 (L2) solution for Ethereum, enhancing scalability and transaction efficiency.

User Growth and Platform Adoption

Lens has seen significant growth in its user base, reflecting the platform's appeal among crypto enthusiasts:

- Total Profiles Created: 517,312 profiles have been registered on Lens, signaling a strong and growing user base.

- Monthly Active Users (MAU): The MAU on Lens has grown from 6,666 in January 2024 to 29,778 in July 2024, marking a 5X increase. This growth demonstrates increasing interest and adoption among crypto natives.

Source: Dune analytics

Engagement Metrics and Publication Trends

While user numbers are on the rise, Lens has experienced a notable fluctuation in engagement, particularly in the number of publications:

- Publications Peak and Decline: Publications on Lens peaked in June 2024, with 276,000 posts. However, by August 2024, this number had dropped sharply to 43,000, indicating a potential challenge in sustaining user engagement.

- Collections as a Key Interaction Method: On Lens, collections serve as the primary method of interaction. Users can post content—such as videos—and offer them either for a fee or for free. Interestingly, 95% of collections are available for free, highlighting a strong emphasis on accessibility and community sharing.

Blockchain Integration and Token Economy

- Bonsai Token Dominance: The launch of the BOnsai token in March 2024 has significantly shaped the Lens ecosystem. Bonsai has become the leading token within the Lens protocol, accounting for 65% of payments related to collections. It is followed by WMATIC, another key token in the ecosystem.

- Long-Term Crypto Native Users: A striking feature of Lens is that 63% of wallets associated with the platform have been active for more than 720 days, underscoring its appeal to long-term, crypto-native users who are well-versed in blockchain technology.

Top Apps on Lens

Lens users primarily interact with three key applications, which are central to the platform's ecosystem:

1. Phaver

2. Hey

3. Orb

These apps are highly competitive within the Lens ecosystem, each vying for user attention and engagement. Despite their similarities, their presence enriches the diversity of interactions on Lens.

Source: Dune Analytics

Current Challenges and Future Directions

Lens has successfully attracted a niche community of crypto natives, but it faces challenges in maintaining and boosting engagement:

- Engagement and Publication Decline: The significant drop in publications from June to August 2024 highlights a need for strategies that sustain and enhance user activity on the platform.

- Monetization Strategy: While Lens offers a promising avenue for creators to monetize their content, expanding this opportunity to a broader user base could be crucial for long-term success.

Comparison with Farcaster

While both Lens and Farcaster serve the crypto social space, they have distinct approaches:

- Interaction with Other Apps: Farcaster emphasizes the integration of interactive apps like Frames and the utility of tokens like Degen across its ecosystem. In contrast, Lens places a stronger focus on interoperability with other decentralized applications (dApps), allowing users to leverage their Lens profiles across various platforms.

- Monetization and Creator Economy: Lens also emphasizes the financial opportunities available to collectors and creators. On average, each collect earns $1 USD, but the top 25 collectors have an average spend of $147, showcasing the platform's potential for monetization and wealth creation within the crypto space.

2.2 Phase Two: Consumer Apps Powered by Crypto

Description: Examination of the anticipated second phase, where mainstream consumer apps will utilize crypto as the underlying infrastructure without the need for users to be crypto-savvy.

Polymarket: The New Way to Bet on Things That Matter

Polymarket stands out as the largest prediction market in the world, on existance since its inception in 2020. The platform allows users to place bets on the outcomes of a wide array of events, ranging from political elections to cultural phenomena, making it a versatile and engaging platform for predicting future outcomes. Unlike traditional gambling platforms, Polymarket offers users the ability to bet on almost anything of public interest, from political events to cultural moments, and even environmental phenomena.

Historical Context and Recent Resurgence

Polymarket first gained significant attention during the 2020 U.S. Presidential Election, where it allowed users to bet on the outcome of the race between Donald Trump and Joe Biden. This event marked one of the platform's earliest successes, showcasing its potential to host high-stakes prediction markets.

Fast forward to 2024, Polymarket has experienced a remarkable resurgence:

- Bet Volume Growth: The platform saw a dramatic increase in bet volume, growing from $6.6 million in December 2023 to $54 million in January 2024. This growth was only a precursor to the even more substantial surge that occurred by July 2024, when the bet volume reached an astonishing $387 million. This nearly 8X increase in a single month underscores Polymarket's growing popularity and its ability to attract significant user engagement.

Source: Dune Analytics

Diverse Market Offerings

One of the key reasons for Polymarket's success is its ability to cater to a broad range of interests:

- Political Events: Polymarket's bread and butter have traditionally been political prediction markets, particularly those surrounding U.S. elections. These markets continue to attract substantial attention and bet volume.

- Sporting Events: The platform has also expanded into sports, offering markets for major events like the Olympics and the Super Bowl. For example, the Super Bowl Championship 2025 market alone has garnered over $8 million in bets, highlighting the platform's ability to compete with traditional sports betting platforms.

- Cultural and Unusual Markets: Polymarket differentiates itself further by creating markets around cultural and unusual events. Examples include bets on whether July 2024 would be the hottest month on record or predictions related to geopolitical events such as the Ukraine-Russia conflict or tensions between Iran and Israel. These markets often provide opportunities for users to bet on events that are not covered by conventional gambling platforms.

User Experience and Platform Usability

Polymarket operates on the Polygon blockchain, a Layer 2 (L2) solution for Ethereum, which offers users the advantages of lower fees and faster transaction times. The platform primarily uses USDC, a stablecoin, for its transactions, providing a stable medium for betting and payouts:

- Ease of Use: Once funds are deposited into a user's Polymarket wallet, the platform is straightforward to navigate. Users can easily buy shares in various markets, sell their positions, and manage their bets with minimal friction. This user-friendly interface has made Polymarket one of the most accessible Web3 platforms available today.

- Challenges in Onboarding: Despite its ease of use, the process of getting funds into Polymarket remains somewhat cumbersome. Converting funds into USDC on the Polygon network can take time, which might deter some users. However, once the funds are in the system, the betting process is seamless.

Positioning in the Crypto Consumer App Ecosystem

Polymarket exemplifies the transition into Phase 2 of consumer crypto apps, where the focus shifts from purely crypto-native users to broader adoption. Its ability to engage users across various sectors—economic, political, and cultural—positions it as a leading platform in this evolving landscape:

- Absence of a Native Token: Unlike many other platforms in the Web3 space, Polymarket does not have its own native token. Instead, it operates entirely using USDC, which adds a layer of stability and simplicity to its markets. This decision may have contributed to its appeal among users who prefer the reliability of a stablecoin over the volatility often associated with platform-specific tokens.

Conclusion

Polymarket is on track to become one of the most important platforms in the crypto space. Its unique approach to prediction markets, combined with its expansive range of betting options and user-friendly interface, makes it a powerful tool for those looking to speculate on the outcomes of various events. As it continues to grow and evolve, Polymarket's ability to tap into what people care about—whether it's politics, sports, or global events—will likely drive its continued success in the years to come. The absence of a native token and the use of USDC also differentiate it from many other platforms, offering a stable and reliable environment for its users.

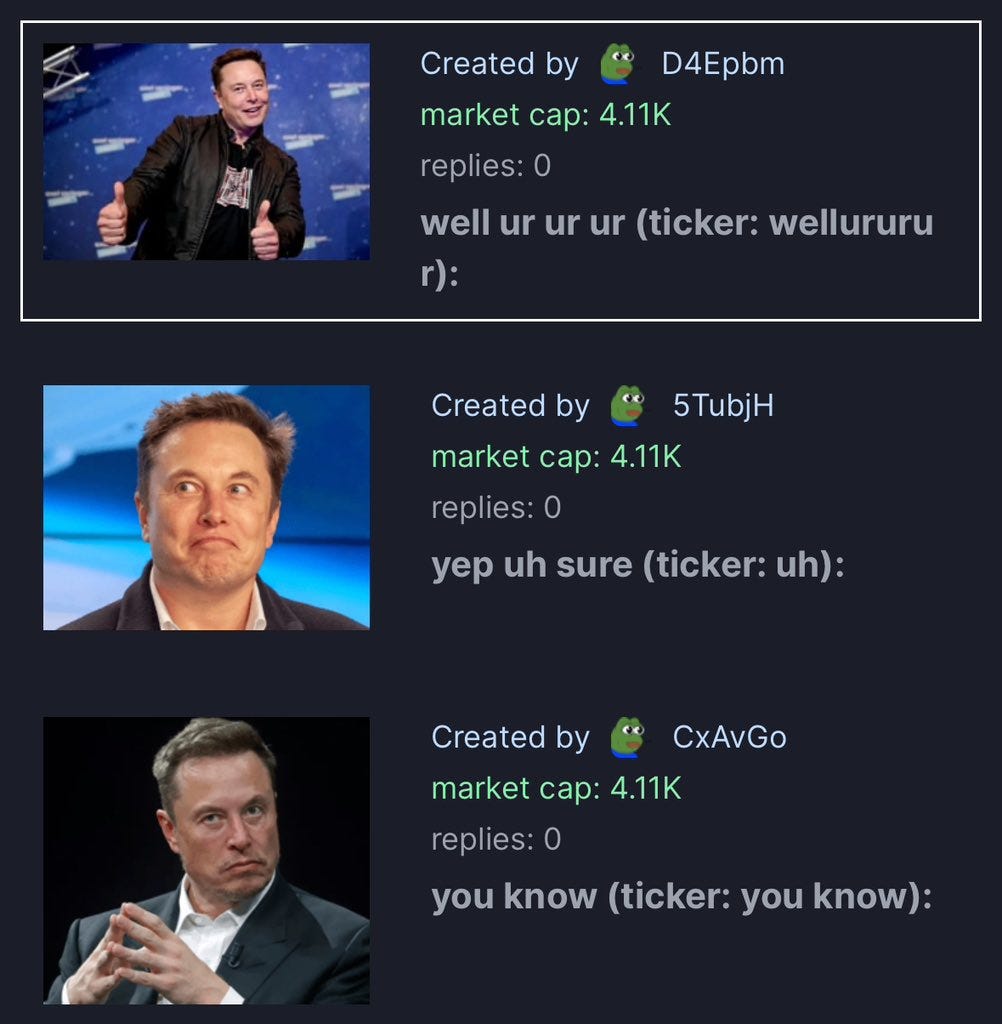

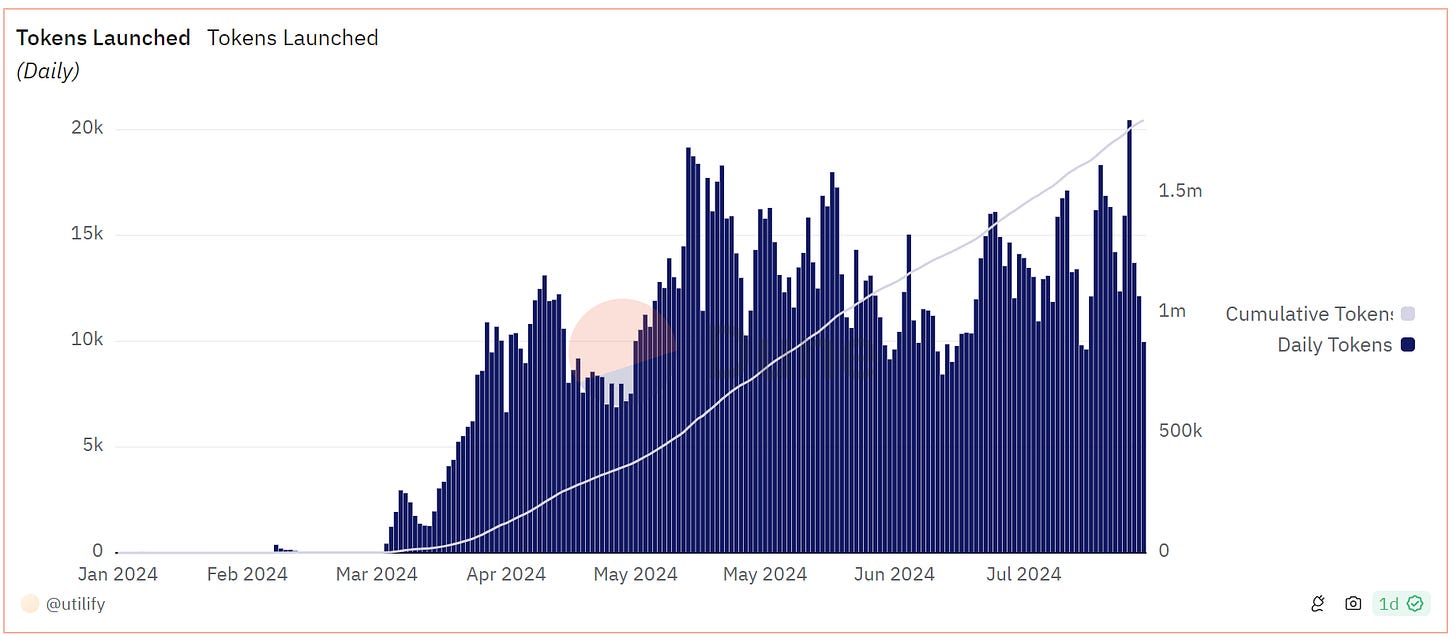

Pump.fun: The Wild West of Meme Tokens

Pump.fun has rapidly become the go-to platform for launching, buying, and selling meme tokens on the Solana blockchain. Known for its simplicity and accessibility, Pump.fun has captivated a wide audience, becoming both a beloved and controversial platform. It has earned a reputation as the number one place for those looking to make—or lose—money in the volatile world of meme tokens. The platform's popularity has grown exponentially, reflecting the broader trend of "Pumponomics," where the thrill of launching and trading tokens rivals traditional forms of gambling.

Explosive Growth and Revenue

The platform's growth can be seen in its staggering revenue increase within a few months:

- Revenue Statistics: In March 2024, Pump.fun generated daily revenue of $51,738. By August 17, 2024, this figure had skyrocketed to $511,012—a nearly tenfold increase. This explosive growth underscores the platform's massive user base and the sheer volume of transactions happening on a daily basis.

- Token Launches: In just the last 24 hours, 9,368 tokens were launched on Pump.fun. However, only a small fraction—less than 1%, or 123 tokens—managed to surpass the $70,000 liquidity threshold required to list on Raydium, a popular decentralized exchange on Solana. This highlights the high-risk, high-reward nature of the platform, where the vast majority of tokens fail, but a few can achieve significant success.

Source: Dune Analytics

Pumponomics and Market Dynamics

Pump.fun operates on what can be described as "Pumponomics"—the economics of pumping and dumping tokens, particularly meme tokens. This model has turned the platform into a sort of gambling arena where users hope to strike it rich with the next big meme token, despite the overwhelming odds:

- Market Dominance: Despite the high risk, Pump.fun remains dominant in the Solana meme token space, with 50% of all meme token launches on Solana happening through the platform. This dominance has not gone unnoticed, prompting competitors like Deckscreener to launch rival platforms such as Moonshot in an attempt to capture some of the market.

- The Appeal of Real-Time Action: What sets Pump.fun apart is the entertainment factor. Unlike buying a lottery ticket and waiting for results, users can watch their token's fate unfold in real-time. This real-time engagement, combined with fast and cheap transactions on the Solana blockchain, makes the experience more interactive and thrilling for users.

User Experience and Platform Usability

Pump.fun's user-friendly design is one of the key factors behind its rapid adoption:

- Ease of Use: The platform is incredibly easy to use, even for those new to the crypto space. Users can quickly get started by connecting their Phantom wallet or using one of the many Solana bots that facilitate rapid buying and selling.

- Fast and Cheap Transactions: Built on Solana, Pump.fun benefits from extremely fast transaction speeds and low fees. This is a stark contrast to the DeFi summer of 2021, where users on Ethereum-based platforms like Uniswap often paid hundreds of dollars in gas fees. On Pump.fun, meme tokens can be bought and sold for mere cents, making the platform accessible to a wide audience.

The Future of Pump.fun and Consumer Crypto Apps

Pump.fun represents more than just a meme token trading platform—it symbolizes the broader possibilities of blockchain technology in consumer and social apps:

- Technology and Innovation: The platform's success showcases the potential of blockchain technology to create new forms of entertainment and financial interaction. The same principles that drive Pump.fun—speed, low cost, and user engagement—could be applied to a wide range of other consumer and social apps in the future.

- Social Dynamics: Initially, the platform's focus on meme tokens attracted a niche audience. However, as more users have engaged with the platform, it's clear that this is part of a broader trend in how people interact with digital assets and each other online. Pump.fun has embraced this evolution, reflecting changing attitudes towards risk, entertainment, and community in the digital age.

Conclusion

Pump.fun is both a phenomenon and a cautionary tale. Its explosive growth, fueled by the thrill of meme token trading, has made it a leader in the crypto space. However, it's crucial for users to approach the platform with caution. The vast majority of tokens launched on Pump.fun will fail, leading to significant financial losses for those who don't manage their risk appropriately. As the platform continues to evolve, it will be interesting to see how it influences the broader landscape of consumer and social apps in the crypto world. Whether you love it or hate it, Pump.fun is undeniably shaping the future of crypto interactions.

Hamster Combat: The Next Big Thing in Gaming

Hamster Combat has quickly emerged as a top player in the tap-to-earn (T2E) gaming world, captivating millions with its simple yet engaging gameplay. It has drawn comparisons to the early days of Axie Infinity, but with a few key differences that set it apart. While the game's massive user base is impressive, the accuracy of these figures is difficult to verify, making Hamster Combat a curious mix of Web 3.0 ambition and Web 2.0 opacity.

Staggering Growth or Smoke and Mirrors?

The reported growth of Hamster Combat is nothing short of astonishing, but it's also shrouded in mystery:

- User Statistics: According to the game's creators, the number of active players surged from 2 million in April 2024 to 10 million in May, and by August 2024, it had allegedly surpassed 200 million. These numbers are extraordinary, but without independent verification, they remain speculative.

- Public Engagement: Some evidence of the game's popularity comes from a Twitter Space hosted by Hamster Combat, which reportedly drew over 137,000 listeners. This suggests a significant level of interest, but whether it correlates directly with the number of active players is still uncertain.

Content and Community

Hamster Combat’s strategy extends beyond just the game itself; it’s about creating a whole ecosystem of content and community engagement:

- YouTube Presence: The game’s official YouTube channel boasts more than 35 million subscribers, a figure that rivals some of the biggest names in entertainment. Their videos, often featuring an animated hamster delivering crypto news, have garnered millions of views—5.2 million in just 24 hours on one recent video. This kind of content, both educational and entertaining, is a major draw for the platform.

- Telegram Integration: By leveraging Telegram, a platform already popular within crypto communities, Hamster Combat has embedded itself into the daily routines of its target audience. This integration allows for easy access to the game and enhances the sense of community among players.

The Upcoming Token Launch

One of the most anticipated developments in Hamster Combat’s roadmap is the launch of its own cryptocurrency, the Hamster Token:

- Token Dynamics: The introduction of Hamster Token will be a pivotal moment for the game. Drawing comparisons to the NotCoin launch, there are concerns about the token's potential volatility. Players are curious whether the game will maintain its popularity after the token launch or if it will follow the pattern of initial hype followed by a sharp decline.

- Airdrop Speculation: With a reported 200 million users, the logistics of a token airdrop are daunting. Distributing even a modest amount, like $5 to $10 per user, could strain the platform’s resources. This has led to speculation about the true number of active users and whether a significant portion of them might be bots.

Key Lessons from Hamster Combat

Hamster Combat’s success offers several key insights into the evolving world of consumer apps and P2E gaming:

1. Avoiding the Crypto Label: Despite its crypto-centric gameplay, Hamster Combat has not branded itself as a crypto game. This subtlety allows it to attract a broader audience, including those who may be wary of the volatile crypto market. It’s a smart move that keeps the focus on fun and engagement rather than financial speculation.

2. Simplicity in Content: The game’s content strategy, centered around an animated hamster, is a masterclass in simplicity and accessibility. By making complex crypto topics digestible and entertaining, Hamster Combat ensures its content appeals to a wide audience, from crypto enthusiasts to casual gamers.

3. Leveraging Familiar Platforms: The decision to integrate with Telegram, a platform familiar to its target audience, has been crucial to the game’s success. It demonstrates the power of meeting users where they already are, rather than forcing them to adopt new tools.

Conclusion

Hamster Combat is a fascinating case study in the rapid evolution of play-to-earn gaming. Its explosive growth and content strategy have positioned it as a leader in the space, but questions remain about the sustainability of its user base and the impact of its upcoming token launch. Whether it’s a fleeting phenomenon or the next big thing in consumer crypto apps, Hamster Combat is undeniably at the forefront of the industry's phase two, pushing the boundaries of how games and crypto can intersect.

3. The Technology Stack Powering Consumer Crypto Apps

3.1 Overview of the Infrastructure

Let's peek under the hood of these consumer crypto apps. It's like looking at the engine of a car - lots of moving parts working together to make the whole thing run. In our case, the engine is built on various blockchain networks, each with its own special sauce.

3.2 Key Players in the Infrastructure

3.2.1 Polygon: The Swiss Army Knife

Polygon is like the Swiss Army knife of blockchain networks. It's versatile, efficient, and plays well with others. Apps like Lens (a decentralized social graph) and Polymarket (a prediction market platform) run on Polygon. But why?

1. Scalability: Imagine trying to fill a swimming pool with a garden hose. That's what using some blockchains feels like. Polygon, on the other hand, is like having a fire hose - it can handle a lot more transactions, much faster.

2. Low Costs: Nobody likes paying high fees, right? Polygon keeps transaction costs low, which is crucial for apps that might need to process lots of small transactions.

3. Ethereum Compatibility: Polygon speaks Ethereum's language fluently. This means developers can easily port their Ethereum apps to Polygon without learning a whole new dialect.

3.2.2 Solana: The Speed Demon

Now, if Polygon is a fire hose, Solana is like a jet of water cutting through steel. It's built for speed and high performance. Apps like Pump.fun, a real-time trading game, thrive on Solana. Here's why:

1. Blazing Fast: Solana can process thousands of transactions per second. It's like having a supercomputer when others are using calculators.

2. Low Latency: In the time it takes you to blink, Solana can confirm multiple transactions. This is crucial for real-time applications.

3. Cost-Effective: Despite its speed, Solana keeps costs low. It's like having a sports car with the fuel efficiency of a compact.

3.2.3 Optimism: The Ethereum Enhancer

Optimism is like a turbocharger for Ethereum. It's an "Layer 2" solution, which means it builds on top of Ethereum to make it faster and cheaper. Farcaster, a decentralized social media protocol, runs on Optimism. Here's what makes it special:

1. Ethereum Security: It inherits the strong security of Ethereum. Think of it as building your house on a very solid foundation.

2. Faster and Cheaper: It significantly reduces transaction costs and speeds things up, addressing two of Ethereum's main challenges.

3. Easy Migration: Developers can easily move their Ethereum apps to Optimism with minimal changes. It's like upgrading your car's engine without having to learn how to drive all over again.

3.2.4 The Telegram Open Network (TON): Powering the Next Wave of Crypto Gaming

Imagine if your favorite messaging app suddenly sprouted superpowers and could run an entire blockchain ecosystem. That's essentially what's happening with the Telegram Open Network, or TON for short. It's like Telegram decided to build a rocket ship instead of just upgrading their bicycle.

TON is a blockchain platform that was originally developed by the team behind Telegram, the popular messaging app. Although Telegram stepped away from the project due to regulatory hurdles, the open-source community picked up the baton and ran with it. Now, TON is making waves in the crypto world, especially in the realm of gaming.

TON has some unique features that make it particularly well-suited for gaming applications:

Speed: TON is fast. Really fast. We're talking about processing millions of transactions per second. It's like comparing a cheetah to a snail.

Scalability: Unlike some blockchains that struggle under heavy load, TON is designed to grow seamlessly. It's like a highway that automatically adds lanes when traffic gets heavy.

User-Friendly: TON is designed to be accessible to the masses. It's aiming to be the blockchain your grandma could use, which is crucial for mainstream adoption.

Integration with Telegram: While TON is independent of Telegram now, it still benefits from potential integration with the messaging app's massive user base. It's like having a built-in audience of hundreds of millions of people.

3.3 The Glue That Holds It All Together

These blockchain networks are just part of the story. The full stack includes:

1. Smart Contracts: These are like the DNA of blockchain apps. They're self-executing contracts with the terms written directly into code.

2. Decentralized Storage: Systems like IPFS (InterPlanetary File System) store data across a network of computers rather than in a central server. It's like having your files in a thousand places at once.

3. Oracles: These are the bridge between the blockchain world and the outside world. They feed real-world data into smart contracts. Think of them as the blockchain's eyes and ears.

4. Wallets: These are the user's gateway to the blockchain world. They're like a combination of a bank account, an ID, and a set of keys all rolled into one.

5. Frontend Interfaces: This is what the user actually sees and interacts with. The goal here is to make the complex backend feel as familiar as using any other app.

4. The Big Picture

When you put all these pieces together, you get a system that's decentralized, secure, and (potentially) user-friendly. It's like we've taken the best parts of the internet and supercharged them with blockchain technology.

The challenge now is making all this complex technology feel simple and intuitive to the average user. It's not enough to build a powerful engine; we need to make sure anyone can drive the car.

As we look to the future of consumer crypto apps, it's clear that we're entering an exciting new phase. The report highlights several key developments that point to a bright future for Phase 2 apps - those that utilize crypto as underlying infrastructure without requiring users to be crypto-savvy.

The success of platforms like Polymarket, Pump.fun, and Hamster Combat demonstrates a growing appetite for apps that leverage blockchain technology while maintaining user-friendly interfaces. These apps have shown that it's possible to attract millions of users by focusing on engaging experiences rather than emphasizing the underlying crypto technology.

What makes this an opportune time to build more Phase 2 consumer apps? The report points to several crucial factors:

1. Improved Infrastructure: The maturation of networks like Polygon, Solana, and Optimism has solved many of the scalability and cost issues that previously hindered mainstream adoption. These platforms offer the speed and low transaction costs necessary for consumer-facing applications.

2. User Experience Advancements: We've seen significant progress in creating interfaces that shield users from the complexities of blockchain technology. This allows developers to focus on creating engaging experiences rather than educating users about crypto fundamentals.

3. Growing Mainstream Awareness: As more people become familiar with concepts like digital assets and decentralized applications, the potential user base for Phase 2 apps continues to expand.

4. Diverse Use Cases: The report showcases how blockchain technology can be applied to various domains, from prediction markets to gaming. This diversity suggests there's still ample room for innovation in unexplored niches.

5. Integration with Existing Platforms: The success of apps like Hamster Combat, which leverages Telegram's large user base, demonstrates the potential for crypto-powered apps to integrate with existing popular platforms.

Looking ahead, the challenge for developers will be to create applications that solve real-world problems or provide compelling entertainment while leveraging the unique advantages of blockchain technology. The focus should be on delivering value to users in ways that traditional apps cannot, whether through novel incentive structures, increased transparency, or new forms of digital ownership.

The infrastructure is now in place to support a new wave of consumer crypto apps. With faster networks, lower costs, and improved user interfaces, we're poised to see blockchain technology seamlessly integrated into everyday digital experiences. The next big consumer crypto app could be one that users don't even realize is powered by blockchain - and that's exactly the point.

As we move forward, the success of Phase 2 apps will likely be measured not by their ability to attract crypto enthusiasts, but by their capacity to provide unique value to mainstream users. The stage is set for innovative developers to create the next generation of consumer apps that could bring the benefits of blockchain technology to millions of users worldwide.

The future of consumer crypto apps is not just about building on blockchain - it's about leveraging this technology to create experiences that are more engaging, more equitable, and more user-centric than ever before. The foundations have been laid; now it's time to build.

Attention venture capitalists: the blockchain gold rush isn't about building new chains anymore - it's about leveraging the robust infrastructure we already have to create the next generation of consumer apps. We've spent years perfecting the underlying technology, and now it's time to put it to work. Platforms like Polygon, Solana, and Optimism have solved the scalability and cost issues that once held us back. What we need now are visionary developers and entrepreneurs who can transform this technology into user-friendly applications that solve real-world problems and enhance people's daily lives. The next Uber, Airbnb, or TikTok of the crypto world is waiting to be built, and it won't require inventing a new blockchain - it'll be about using the existing tech in innovative ways. VCs, your next unicorn isn't hiding in a whitepaper for a new protocol; it's in the mind of a developer who's figuring out how to use blockchain to make people's lives easier, more fun, or more profitable. The infrastructure is ready. The market is primed. It's time to shift your focus and your funds to the teams building the consumer apps that will bring crypto to the masses.

Francisco Cordoba Otalora

Follow me on Twitter/X here

References:

https://x.com/winnielaux_/status/1700152768130843092/photo/1

https://www.ournetwork.xyz/p/on223-memecoins?ref=ournetwork.ghost.io#bonsai

https://paragraph.xyz/@joshcrnls.eth/aug-17

https://x.com/alexgedevani/status/1820106412355100969/photo/1

https://x.com/SigridRunte/status/1817203323784909140

https://x.com/cherdougie/status/1746998771765092767

https://x.com/azeemk_/status/1824086867437875350

https://x.com/dwr/status/1715471114112221635

https://x.com/lmrankhan/status/1796264203860189317

https://x.com/mikeybitcoin/status/1798080114766533061

https://darkstar.mirror.xyz/3w5L2Fq4IyeUIjro0lv9oiikRCN1heKDrPqudb1Ieyo

https://x.com/apgdoesweb3/status/1811724509348503892

https://x.com/FitzYap/status/1822019324082618449

https://medium.com/collab-currency/consumer-cryptos-breakout-cycle-2a212f2d1f4b

https://x.com/reganbozman/status/1625538326731317249

https://x.com/reganbozman/status/1625538331831599104

https://x.com/ParallelAiRev/status/1816949117588799629

https://x.com/GabeRabello/status/1816959656956428546

https://tcg.mirror.xyz/vcvbWUqc2h-eAkHzXUrWA6m-nCdr9yLIQP0vz_bDibE

https://dune.com/ilemi/farcaster-explorer

https://dune.com/lens/lens-protocol

https://dune.com/rchen8/polymarket

https://blockonomi.com/1-billion-users-hamster-kombats-ambitious-plans-hmstr-token-airdrop/